The new Mortgage Rules are making it harder for you to get your clients a mortgage. As a result, more and more mortgage professionals are using private mortgage lenders to help their clients achieve their goals. To best help your clients, it is important to understand how private mortgage lenders operate, how the pricing works and the associated costs to ensure what you promise your customers come to fruition, with no surprises.

Who are Private lenders?

To put it simply, any person or company who is not a bank or trust company and is lending money can be a private lender.

The “who” of private money has changed over the last decade: there are numerous private lenders whose main business is lending money, and who manage large to small portfolios of mortgages. There are also individuals who lend their own or other people’s money part-time.

There are three basic types of private lending structures.

1. Funds: Mortgage Investment Corporations (MICs) or Mutal Trust Funds

2. Syndicators

3. Private individuals

How your lender is structured will influence service, product and price offering. As an illustration, let’s consider a loan priced at 10%, with both the lender fee and interest rate combined. The combinations of interest and fees can vary depending on the source.

Funds: Mortgage Investment Corporations (MIC) or Mutual Trust Fund.

There are funds with no management company in which all interest and fees earned go into the one entity as revenue. In this structure, the fund would have flexibility on how the rate and fee are split. Thus, if the borrowing client is fee sensitive, the lender can offset their pricing to accommodate the borrower by adjusting the rate upwards. For example, offering a fee of 1% and rate of 9% rather than a fee of 3% and rate of 7%.

The other fund structures have a separate management company in which the interest rate is earned by the Fund, and the fees are earned by the management company. The management company may also charge the fund a fee for the total mortgages under management. In this structure, the fund may have less flexibility on how the rate and fees are split. For example, the fund may be mandated to charge 2% as a fee and would not be able to adjust this pricing to accommodate the borrower’s request for changes.

Funds traditionally have greater access to capital, bank financing and loans which are paying out all the time, so there are efficiencies in operations to allow for better pricing and service to you and your clients.

Syndicators

A syndicated mortgage is a partnership involving two or more investors in a specific mortgage. A mortgage syndicator will pool investor’s funds to lend on a single mortgage loan. In mortgage syndications, interest is typically earned by the lender partners, and the fees are typically earned by the management company who put the syndication together, and the management company could additionally charge the lender partners for management of the syndication. In this structure, the Syndicator may not have the flexibility on how the rate and fees are split. For example, the manager of the syndication may be mandated to charge 2.5% as a fee and would not be able to adjust this pricing to accommodate the borrower’s fee sensitivities.

The syndicator’s sources of capital can be less readily accessible and may require more time to source than a fund’s. Syndicators tend to have smaller volumes which can have an impact on service.

Private Individuals

In the case of these lenders, all interest and fees earned go to the one individual lender as revenue. The individual would have flexibility on how the rate and fees are split as they earn both. Thus, if the borrowing client is fee sensitive, the lender can offset their pricing to accommodate the borrower by adjusting the rate up, and the fee down. For example, offering a fee of 1% and rate of 9% rather than a fee of 3% and rate of 7%.

Private individuals will likely have less capital available and will not have the resources to service mortgages the same way that larger operators can.

Comparing mortgages

When it comes to pricing and costs, there are costs that can be included in a private mortgage that needs to be considered by you, the mortgage professional, and the borrower. Private mortgage pricing is not uniform across the industry, and thus you should expect distinct requirements from each lender as to their pricing, terms, conditions, and fees. It is important for you to understand your lender’s commitment letter and what costs your borrower will be responsible for.

Some of these costs include:

– Appraisal

– Legal

– Site inspections

– Standby fee

– Pre-payment penalties

– Renewal fee

It is important to understand all costs to compare one lender’s offering to another, and indeed to ensure your client’s needs are being met.

When agreeing to a private mortgage, it is very important to understand your borrower’s situation and what’s important to them. The majority of clients are focused on the interest rate, and certainly the total cost, and justifiably so. It is also important to determine other factors that will assist the borrower to achieve their objectives. To get the most cost-effective option you must consider: how the borrower plans to payout or refinance the mortgage and what is the anticipated timeline to exit the mortgage. The sooner the private mortgage loan is paid out or replaced; the less expensive the financing will be (depending on pre-payment penalties); as such, the most significant avoidable costs, or at least costs that have the potential to be reduced, associated with private loans are early payment penalties and renewal fees. Other costs/fees include NSF charges, Legal costs, Appraisal costs, Compounding rate calculation (compounding semi-annually vs. compounding monthly), Default fee, Insurance default fee, Site inspection fee, and Standby fees.

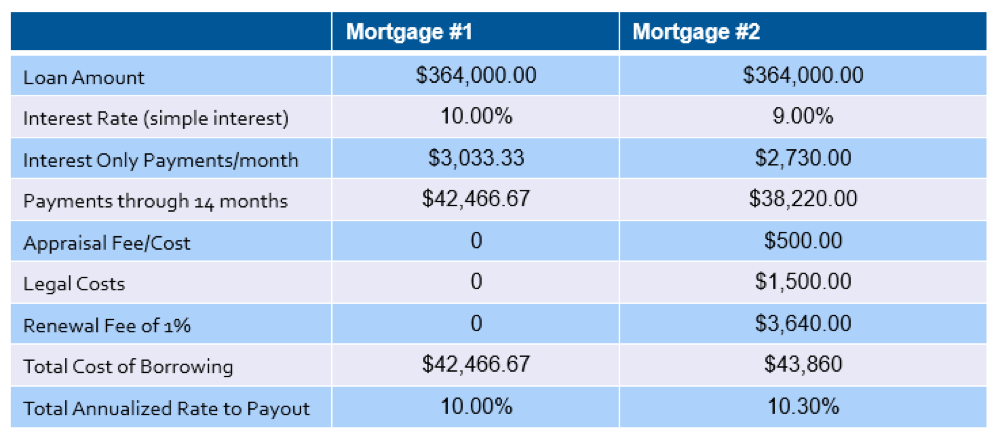

Let’s review a couple of examples of some more commonly charged fees and how they impact pricing as a whole. Here we will look at appraisal costs, legal costs, and renewal fees.

Example 1

Let’s say your client is purchasing a home for $484,849 (the average sale price of a single-family house in Calgary) and requires a mortgage at 75% Loan to value (LTV). This first mortgage loan equals $363,636.75, rounded to $364,000. You have generated two competing loan offers;

Private Lender #1 is offering this loan at a rate of 10% and does not charge appraisal costs, legal costs, or renewal fees.

Private Lender #2 is offering this loan at a rate of 9% and charges appraisal costs of $500, legal costs of $1,500, and renewal fees of 1% ($3,640). The two options are non-amortized loans with simple interest payments.

In this example, the borrower holds the mortgage for 14 months, at payout the total borrowing cost for Private lender #1 is $42,466.67 while the total borrowing cost for Private lender #2 is $43,860. If we were to calculate the total annualized rate, lender #1 remains at 10% while lender #2 ends up a total annualized rate of 10.3%. Please see table below:

Example 2

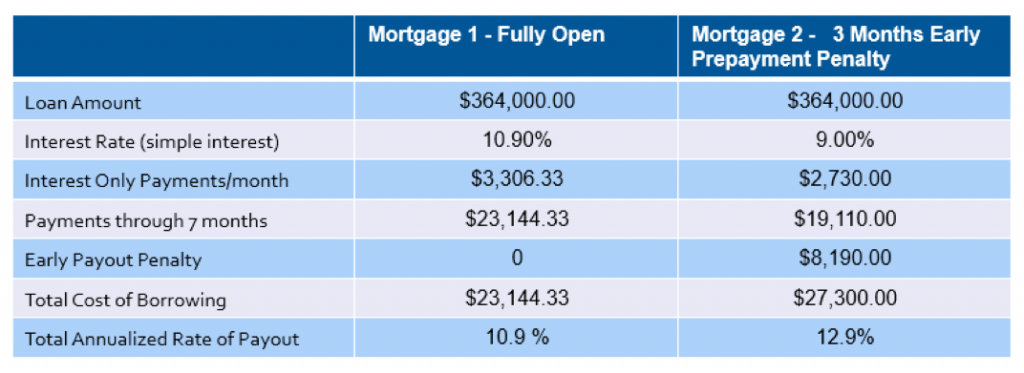

Now let’s look at a different example to outline the impact of prepayment penalties.

Fully open loans will typically be priced at a premium versus closed loans with payout restrictions, this is due to the lender having the uncertainty of their capital coming back early via early repayment.

Again, using 75% LTV of $484,849, then rounded to $364,000 and the loan being non-amortized with simple interest payments. Private Lender #1 is offering this loan at a rate of 10.9% with no early payment restrictions or penalties. Private Lender #2 is offering this loan at a rate of 9% with a 3-month early repayment penalty.

In this example, the borrower holds the mortgage for 7 months, at payout the total borrowing cost for Private lender #1 is $23,144.33 while the total borrowing cost for Private lender #2 is $27,300. If we were to calculate this as total annualized rate, lender #1 remains at 10.9%, while lender #2 ends up being the more expensive option for the borrower with a total annualized rate of 12.9%. Please see table below:

It is important to note that the effective rate of interest calculation does not take a prepayment penalty into account on most disclosures. As Mortgage Associates, we are all trained to consider the effective rate of interest (APR), but many do not recognize that penalties are not included in the calculation (because they can’t be predetermined for a specific payout date).

Conclusion

The better you know your private lending partners and what their full product, servicing and pricing model is, the better equipped you will be to serve your borrowing clients when the banks can not. It is important to keep in mind the various fees and charges related to a private mortgage loan and that these will differ from lender to lender. In order to best serve your clients and place them with the lender who will be the most cost-effective it is important to keep abreast with these cost structures. A private mortgage loan will not be appropriate for all borrowers, and the better you know the offerings of the lenders, the better match you will be able to make for your clients who will benefit from a private lender, and in turn, you can grow your business