When it comes to real estate investor financing, many investors start by asking one question: What’s the rate?

Rates matter, but they’re only one piece of the total cost of capital. The true cost of financing also depends on how quickly you can access funds, how much capital you keep available for other deals, and how flexible your lender is when your plans evolve.

Equally important – and often overlooked – are the fees associated with a deal. Beyond interest, real estate investors should consider Lender and Broker fees, appraisal and legal costs, potential renewal or extension fees, and any early payout or discharge costs. These can significantly influence your total project costs and your overall return.

When it comes to flips and BRRRs (Buy, Renovate, Rent, Refinance), speed and structure often matter more than rate. The best deal on paper means nothing if you can’t close on time, fund your renovation, or pivot when the market shifts.

Beyond the Rate: What Drives Real Estate Investment Success

Sophisticated real estate investors look at the entire deal structure, not just the interest rate. Real success hinges on:

- How quickly you can access capital

- How much of your own capital you keep available

- Flexibility to exit when your plan calls for it

- The ability to leverage market value, not just purchase price

These factors define your ability to stay competitive, seize new opportunities, and maximize your return on invested capital.

You create the opportunity. Financing should support your execution, not slow it down.

What to Consider When Comparing Lending Options

- Amount of Capital Required

The less capital you tie up, the more deals you can complete. Lower down payment options allow you to scale faster and improve your overall return. - Timeline to Fund

Great deals don’t wait. The lender’s funding speed can make or break an opportunity – especially in competitive markets or when sellers prioritize certainty. - What the Lender Bases Value On

Most lenders finance only on the purchase price. At Calvert Home Mortgage, we lend based on the current market value, providing real estate investors with leverage when they buy properties below market value, and support them in accessing more working capital. - Term Structure & Flexibility

Your term structure impacts both your exit strategy and your monthly cash flow. Compare options such as interest-only versus amortized payments, open versus closed mortgages, and whether early payouts or extensions are allowed without penalties. At Calvert Home Mortgage, we offer fully open, interest-only mortgages built for real estate investors, providing the flexibility to payout at any time without prepayment penalties. - Rates & Fees

A rate alone does not determine the total cost of capital. Fees often play a bigger role in your final outcome, especially for short-term projects. When comparing lenders, review all fee components, including:- Lender and Broker fees

- Whether fees are included in the loan amount (important for the Loan-to-Value (LTV) calculation and cash-to-close)

- Appraisal costs

- Legal and closing fees

- Renewal or extension fees

- Early payout or discharge fees

- Other administrative or processing costs

A slightly higher rate paired with lower fees or a more flexible loan structure can cost significantly less overall and allow you to keep more capital liquid. Conversely, a low advertised rate with high or unexpected fees can erode your margin.

Always compare the full fee structure, not just the rate. Your profitability depends on the total cost of capital, not a single number.

- Transparency

The best lenders make pricing and terms clear up front. At Calvert Home Mortgage, transparency is at the core of how we operate – because confident real estate investors make confident decisions.

Why Structure and Speed Matter More than Rate

Before focusing on the rate, run the numbers on the total cost of capital. A lender with a higher rate but lower fees, faster turnaround, and more flexible structure may deliver a more substantial potential return, especially if it enables you to take on more projects with the same capital.Before focusing on the rate, run the numbers on the total cost of capital. A lender with a higher rate but lower fees, faster turnaround, and more flexible structure may deliver a more substantial potential return, especially if it enables you to take on more projects with the same capital.

Consider the following real-world scenario.

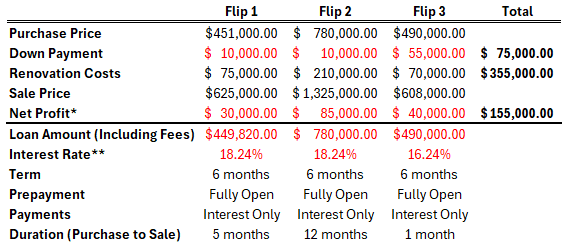

A real estate investor completed three successful flips in roughly 15 months using fast, flexible financing. Even though the interest rate was higher, the real estate investor was able to move quickly, preserve capital for renovations and carrying costs, and keep deals flowing – turning over three properties with only $75,000 tied up in down payments.

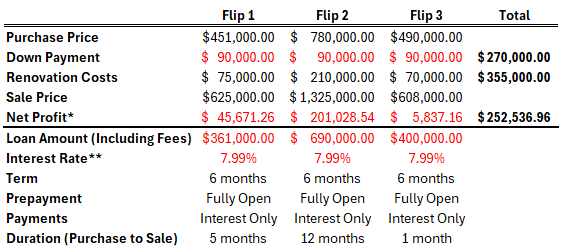

Now compare that to a slower, lower-rate strategy – one that requires higher down payments and reduced rates.

On paper, the lower-rate approach appears more profitable per deal. However, that assumes the real estate investor has access to nearly four times the capital for down payments, as well as sufficient funds for renovations and carrying costs. In reality, many real estate investors can’t deploy that much capital at once.

In this example, the real estate investor who leveraged lower down payments earned less per project but was able to complete three profitable flips in the same timeframe, resulting in stronger overall returns, higher ROI, and greater momentum.

*Net profits are not guaranteed and will vary depending on the project. Interest rates and fees are determined on a deal-by-deal basis and can change based on several different factors. **Rates are subject to change. Contact us for current rates.

Speed and Structure Beat Rate

A lower rate doesn’t matter if you can’t do the deal. Liquidity equals opportunity, and speed beats rate.

When comparing real estate lending options, look beyond the rate sheet. Evaluate how the lender’s structure, flexibility, and speed align with your goals.

At Calvert Home Mortgage, we support real estate investors to execute faster, preserve capital, and scale confidently – because the right financing should empower your next move, not delay it.

Ready to Structure Smarter Deals?

Comparing lending options is more than chasing the lowest rate. It’s about understanding how structure impacts your speed, flexibility, and ROI. Explore more real estate investor insights and financing strategies on our Learn page.

We’d love to hear from you: What’s the biggest factor you consider when choosing a lender? Join the conversation by reaching out to our Business Development team today.

Alberta | Kaelan Nelson

Email: kaelan@chmic.ca

Cell: 587-585-4571

Book a meeting here.

Ontario – GTA | Katarina Jarossy

Email: katarina.jarossy@chmic.ca

Cell: 416-799-2553

Book a meeting here.

Ontario – Anywhere Else | Dan Werner

Email: dan.werner@chmic.ca

Cell: 416-316-5336

Book a meeting here.

FAQs: Comparing Real Estate Lending Options

Q: Why shouldn’t I choose a lender based solely on the lowest interest rate?

A: A low rate doesn’t always mean the best outcome. If the lender requires a larger down payment or takes weeks to fund, you risk losing opportunities or tying up capital you could use elsewhere. The best financing supports your deal strategy, not just your balance sheet.

Q: How does lending on market value benefit real estate investors?

A: Many lenders base their loans only on the purchase price. Calvert Home Mortgage lends on the current market value, which means if you buy below market, you can borrow against the higher value. This increases leverage and frees up more capital for renovations, carrying costs, or additional projects.

Q: How important is funding speed when flipping or refinancing?

Critical. In a competitive market, the real estate investor who can fund quickly often wins the deal. Fast access to capital lets you secure properties, start renovations sooner, and turn your capital over more efficiently.

Q: What’s the difference between open and closed term mortgages?

A: An open mortgage allows early repayment at any time without penalty – ideal for short-term projects like flips and BRRRs (Buy, Renovate, Rent, Refinance). A closed mortgage offers a lower rate but limits the flexibility of early payout. Choosing the right structure depends on your project timeline and exit strategy.

Q: How can I decide which lender is right for me?

A: Ask yourself: Can they fund fast enough to keep my deals moving? Do they lend on market value or only on purchase price? Are their terms flexible if my project timeline changes? Do I clearly understand all rates and fees upfront? If the answer is “yes” to all the above, you’ve found a lender who supports your success, not one who slows it down.

TL;DR

When comparing real estate lending options, don’t just focus on the interest rate. The true cost of capital includes how fast you can access funds, how much of your own cash stays liquid, and how flexible your lender is when your plans shift. Fees, renewal or extension costs, appraisal and legal fees, and payout or discharge fees all impact your real return and should be part of every lender comparison.

The most successful real estate investors prioritize deal structure, speed, and flexibility over the lowest rate. The right financing keeps your capital working, supports multiple projects at once, and helps you scale your portfolio faster.

At Calvert Home Mortgage, we lend on market value (not just the purchase price), fund quickly, and offer transparent terms designed to support real estate investors to execute faster and protect liquidity.