Background Story

A Mortgage Broker approached Calvert Home Mortgage requesting a Second Mortgage for his/her mother (“client”) for the purpose of consolidating debt. The client required the mortgage to pay off her high credit balances which were impacting her Credit/Beacon Score. Her credit was good, but Beacon was low due to high balances compared to credit limits. She made all of her payments over the last 2 years and had all “R1’s” on her Credit Bureau. When the file was initially presented to Calvert, the client’s Credit Score was 567. With this low of a Credit Score she was not able to approach the banks for refinancing even though there appeared to be sufficient equity in the property. The current First Mortgage holder was also unwilling to provide an increase in loan amount.

Documents Reviewed

♦ Mortgage Application

♦ Current Credit Bureau

♦ Current Employment Letter and Pay Stub

♦ Current First Mortgage Statement

Calvert Solution

Offer a Second Mortgage to consolidate debt to improve mother’s Credit Score.

Valuation of Property

Calvert was able to complete an in-house valuation of the subject property with a value of $410,000. We can complete in-house valuations for properties within the Calgary, Edmonton and Red Deer areas. The in-house valuations are completed at no cost to your clients and can provide significant savings.

Loan to Value

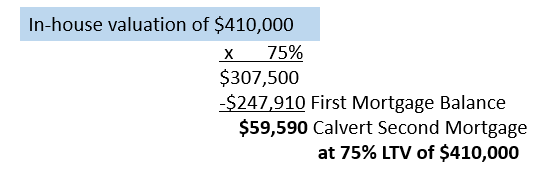

Calvert will consider up to a maximum of 75% Loan to Value (“LTV”) for debt consolidation mortgages within Calgary and Edmonton. The following was the LTV calculation for this deal:

Calvert Pricing

Interest Rate: 12%

Term: 6 Months

Prepayment: Fully open and may be paid out at any time without notice, bonus or penalty

Amortization: Not Applicable/Interest Only Mortgage

Calvert Fee: $1,500 (Calvert’s minimum file fee)

Broker Fee: Nil (the ‘Mom’ discount applied)

How Calvert Added Value

The Mortgage Broker’s request was a consolidation loan to help improve the client’s Credit Score by paying down/out credit accounts with high balances. We consulted with a credit professional who determined that the following would be required to increase her credit score above 680:

1) Pay all credit card debt to $0;

2) Responsibly use credit cards over the next few months; and

3) Pay all statements in full before balance is due.

The client saved $300 (+/-) by Calvert completing an in-house valuation as opposed to a third party appraisal for her property.

Calvert was also able to do an in-house signing with the client for funding of the mortgage. An in-house signing does not involve a lawyer and can be done when the client is the owner of the subject property and nothing is being discharged from Title, which further saved the client money. The only cost involved with funding a mortgage without a lawyer at Calvert is the Title Insurance policy, which is $300.

We value the trust Brokers place in us in working with their clients, and in this case, the Broker’s own mother. We protect Brokers for their clients, sending clients back to you at renewal, and for refinancing when an opportunity arises.

Results

The client was able to meet at the Calvert office to sign the documentation and fund her second mortgage. It was then up to the client to take the advice that she had received and apply it towards the improvement of her credit; and of course, we were there to assist if she or the Broker needed support.

The client understood the importance of keeping good credit during the period of our mortgage with her. On May 16, the client’s credit score was 567 and when credit was pulled again three months later her score was 769; that’s an improvement of over 200 points in just 3 months!

The Mortgage Broker was able to refinance both the First and Second Mortgages with the current First Mortgage holder after providing them with the improved Credit Bureau. It was amazing to see such an improvement to her Credit Score and we are thankful that the Mortgage Broker thought of Calvert to assist their mother with short-term financing.